How to Generate Extra Income From Your Stocks With This Simple Option Strategy

Ever look at your stock portfolio and wonder if there's a way to squeeze some cold, hard cash out of it? As it turns out, there absolutely is!

The strategy that makes this possible is known as a covered call. Covered calls are one of the easiest ways to generate income using options for two key reasons: the concept is simple and easy to implement. These qualities make it a beginner-friendly and effective way to generate additional income from your portfolio.

With that primer out of the way, let's dive deeper into this income-producing beast so you can start building up some serious cash flow!

This content is for informational purposes only and should not be considered financial, investment, tax, or legal advice. You should consult a qualified professional before making any financial decisions. Some posts may contain affiliate links, meaning I may earn a commission if you sign up or make a purchase through my links, at no extra cost to you. All recommendations are based on my research and personal experience. Please conduct your own due diligence before making any financial decisions.

What is a covered call?

Imagine placing a bet that a stock you own will stay below a certain price by a specific date—and getting paid upfront just for making that call. If you're right, you pocket the cash as pure profit. If you're wrong, you still keep the payment but agree to sell your stock at that predetermined price. That's covered calls in a nutshell.

Here's how it works:

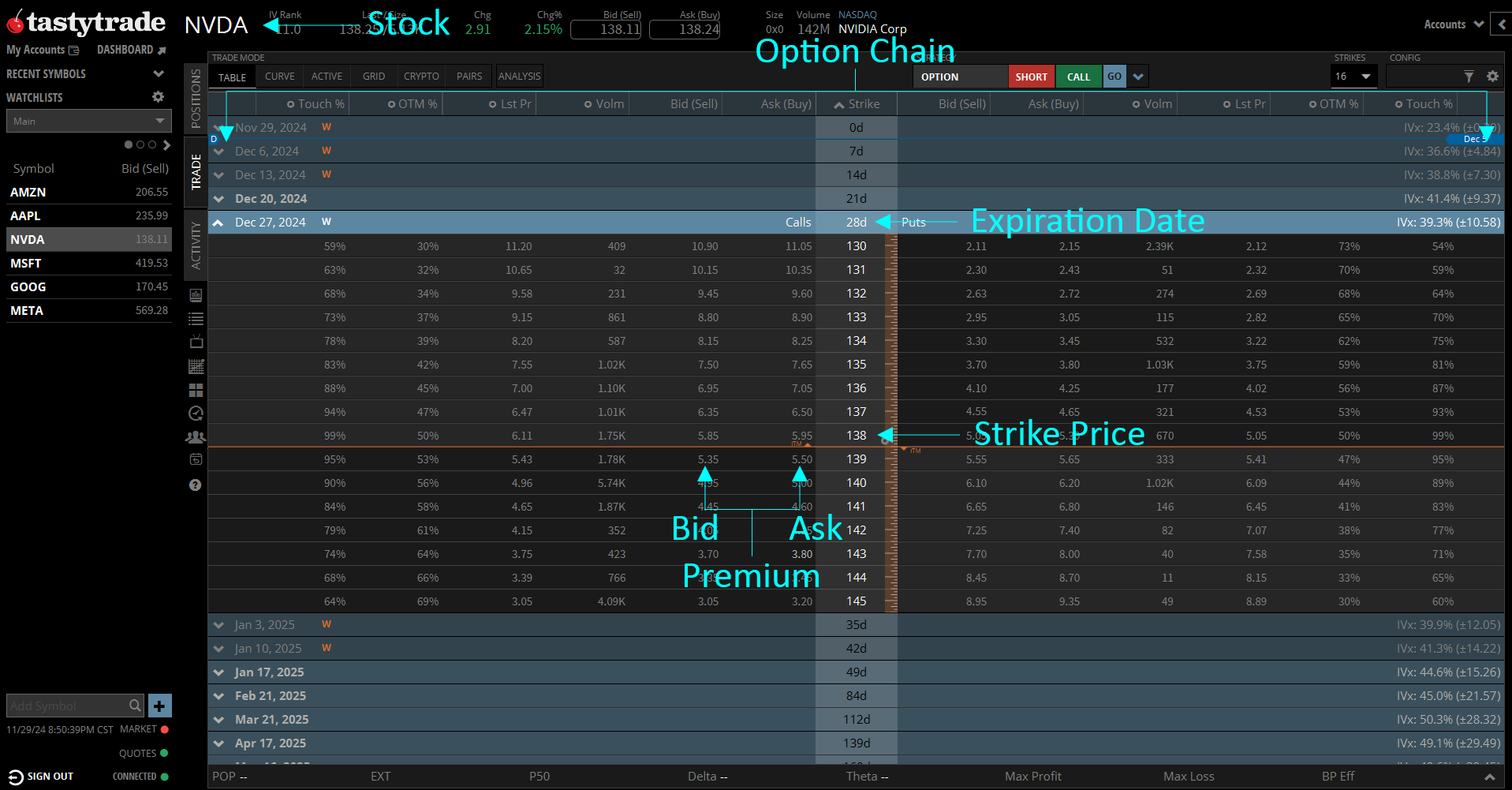

You sell (write) a call option with a target price (strike price) you believe the stock will stay below by a specific date (expiration date) for a stock you already own. Each option contract represents 100 shares of an underlying stock, so you'll need to own 100 shares to write a covered call and fulfill the obligation to sell if the option is assigned. In return, you receive cash (premium) for selling the option, which is deposited into your account right away.

After selling a covered call, one of two likely outcomes will occur:

- The option expires Out the Money (OTM): You pocket the premium and keep your stock. "Out the Money" means the stock price is below your strike price, keeping it outside of assignment range.

- The option expires In the Money (ITM): This triggers automatic assignment, requiring you to sell your stock at the strike price—though you still keep the premium. "In the Money" means the stock price is at or above your strike price, putting it within assignment range.

You might even face early assignment if the buyer chooses to exercise their option before it expires. While early assignment is rare, it’s still possible and worth keeping in mind.

You also have the option to buy back your call before it expires. Suppose the stock price is well below your strike price as expiration nears; the call's value will likely have decreased considerably, allowing you to buy it back for much less than you originally sold it for—resulting in a substantial percentage gain. Conversely, If the stock price is well above, the call's value will have likely increased, meaning you'd repurchase it at a loss—but keep your shares.

Let's go over some brief examples:

Dante owns 100 shares of Tesla at an average price of $200. The stock has been trading between $230 and $260 for several months, and Dante expects this range to hold. To capitalize on this, he sells a call option at the $260 strike price, expiring in 30 days, and receives $315 in premium. Thirty days later, Tesla closes at $258. Dante's covered call expires OTM, allowing him to keep the entire $315 premium while still holding on to his 100 shares of Tesla.

Aria owns 200 shares of Apple at an average price of $100, with the current stock price at $193. She's comfortable selling her shares at $200 or higher and wants to generate extra income while waiting. To achieve this, she sells two covered calls—one at the $200 strike price and another at the $215 strike price, both expiring in 30 days. For these, she receives $212 and $46 in premiums, respectively. Thirty days later, Apple closes at $201. Aria's $200 covered call is assigned, requiring her to sell 100 shares of Apple at $200, yielding a 100% profit on those shares, plus the $212 premium. Meanwhile, her $215 covered call expires OTM, allowing her to keep her remaining 100 shares and the additional $46 premium.

In both cases, Dante and Aria successfully generated extra income through premiums by strategically managing their risks and goals based on their target stock prices.

When to sell covered calls

As you might imagine, covered calls work best in stable, favorable market conditions. Applying this strategy during periods of uncertainty or heightened volatility could cause you to miss out on greater gains, underscoring the importance of timing.

The optimal time to sell covered calls is when the stock price is most likely to remain below your strike price by expiration. This reduces the risk of losing your shares early and missing out on additional profits. The primary objective is to hold onto your shares for as long as possible while maximizing their upside potential. Meanwhile, you’ll generate consistent income through the premiums collected from covered calls. The ideal condition for selling covered calls is after volatility has stabilized and price movements become more predictable.

Ideal scenarios for covered calls:

- When a stock is consistently trading within a defined range, bouncing between two price levels

- When a stock is gradually trending upward

- When a stock is trading flat

Non-ideal scenarios for covered calls:

- When the stock exhibits strong upward momentum with frequent and substantial price increases

- When a significant catalyst is upcoming (e.g., earnings announcements, investor conferences.)

- When volatility is high, causing unpredictable and erratic price swings

You can also employ a variation of the covered call strategy known as ATM (At The Money) buy-write. With this method, you purchase 100 shares of a stock and simultaneously sell a covered call at the same strike price as your purchase price. This strategy focuses purely on generating income by prioritizing immediate premium payments over potential stock appreciation. ATM calls offer significantly higher premiums than OTM calls due to their increased likelihood of ending ITM, which boosts their value. Because this strategy focuses on income, it's particularly effective with high-volatility stocks, as elevated volatility drives up premiums—putting more cash in your pocket.

After executing an ATM buy-write, one of two likely outcomes will occur:

- Your option expires ITM, requiring you to sell your shares for little to no gain. However, you still keep the hefty premium.

- Your option expires OTM, leaving you with 100 shares. The premium collected significantly reduces your average cost basis, improving your position on the stock.

How to sell a covered call

You might think this all sounds complicated, but that couldn't be further from the truth. Writing a covered call is surprisingly straightforward, especially with a broker that offers a user-friendly options platform. Personally, I use Tastytrade, and it’s my top recommendation for anyone trading options. Let me show you just how easy it is.

As you can see, it takes only seconds to write a covered call and have the premium credited to your account. Simply navigate to the stock's option chain and sell (or short) a call option at the strike price and expiration date of your choice. One of the best aspects of this strategy is its scalability—you can sell one covered call for each 100-share lot you own. This flexibility allows you to generate significant cash flow with a large portfolio or start small and gradually build your way up!

Bottom Line

Covered calls are an excellent way to generate additional income from your portfolio, complementing your dividends and capital gains. It's a straightforward, accessible strategy with a relatively low barrier to entry, but it’s not without risks. The possibility of assignment and potentially losing your stock is real—so it's crucial to sell covered calls strategically in favorable market conditions. Doing so will allow you to capture as much upside as possible from the stock while maximizing the premiums collected.

You can boost your chances of success with this strategy by expanding your knowledge on topics such as technical analysis, stock fundamentals, and market sentiment. I'll cover these in future posts, so if you're interested in learning more, subscribe to my newsletter to stay updated.

I hope you found this guide helpful—I'll see you in the next one!

NewAgeFinance Newsletter

Join the newsletter to receive the latest updates in your inbox.