How to Make Thousands of Dollars Each Year With Bank Bonuses

Got some spare cash, decent organizational skills, and a love for easy money? If so, chasing bank bonuses might just be the perfect side hustle for you!

Clear, practical, and rewarding—bank bonuses provide an easy, low-risk way to build a side income stream with minimal time commitment. With countless banks vying for your business, this strategy could be more lucrative than you might imagine.

With that covered, let’s explore the world of bank bonuses and get you on your way to racking up some Benjamins!

This content is for informational purposes only and should not be considered financial, investment, tax, or legal advice. You should consult a qualified professional before making any financial decisions. Some posts may contain affiliate links, meaning I may earn a commission if you sign up or make a purchase through my links, at no extra cost to you. All recommendations are based on my research and personal experience. Please conduct your own due diligence before making any financial decisions.

What is a bank bonus?

A bank bonus is a cash incentive for opening an account and meeting specific requirements. Banks offer these bonuses to attract new customers, hoping you’ll continue using their services long after receiving your reward.

The requirements for these bonuses vary, giving you the flexibility to target banks with terms that align with your financial capabilities.

Let’s take a look at the most common requirements you’ll come across.

Requirement 1: Direct deposit

A direct deposit requirement means having payroll from your employer or business directly deposited into your bank account, reaching a specified amount within a set timeframe.

Here’s an example:

Archie opens a bank account with a $300 bonus offer for setting up direct deposits of at least $500 per month for three consecutive months. He updates his payroll settings to deposit $500 from each paycheck into his new account. Over the next three months, Archie successfully meets the direct deposit requirement, receiving over $500 monthly. By the fourth month, the bank rewards him with the $300 bonus.

Some banks even count transfers from your other bank accounts as a direct deposit, so you don’t always have to mess with your payroll settings. Instead, you can simply link your new bank account to an existing one and initiate an ACH transfer from there, which should satisfy the direct deposit requirements for certain banks.

These banks typically recognize ACH transfers as direct deposits:

- Wells Fargo

- U.S. Bank

- PNC

- Truist

- Citi

Conversely, Chase and Bank of America are examples of banks that require an actual payroll deposit to qualify for their bonus, as the ACH transfer method doesn’t work there.

Requirement 2: Debit card purchases

A debit card purchase requirement means completing a specified number of debit card transactions within a defined timeframe.

Here’s an example:

Veronica opens a bank account with a $250 bonus offer for making 25 debit card purchases within the first three months. During this period, she uses her debit card for everyday expenses such as groceries, gas, and dining. Two weeks after completing her 25th transaction, the bank credits her account with the $250 bonus.

Debit card purchases can also be easily fulfilled with $1 transactions through your insurance, internet, utility provider, or other similar services.

Requirement 3: Balance maintenance

A balance maintenance requirement means keeping a specified amount of money in your account for a designated period.

Here’s an example:

Betty opens a bank account with a $400 bonus offer for maintaining a minimum daily balance of $5,000 for 90 days. She deposits $5,000 and keeps that balance intact throughout the period. On the 91st day, the bank credits her account with the $400 bonus.

To evaluate whether these bonuses are worthwhile, calculate the annualized return rate and compare it to your current savings account rate. Use this formula:

(Bonus Amount ÷ Balance Required) × (365 ÷ Holding Period Days) × 100

Using Betty’s case as an example:

(400 ÷ 5000) × (365 ÷ 90) × 100 = 32%

This calculation shows that her annualized return rate is 32%, significantly higher than the average savings account rate.

Tips

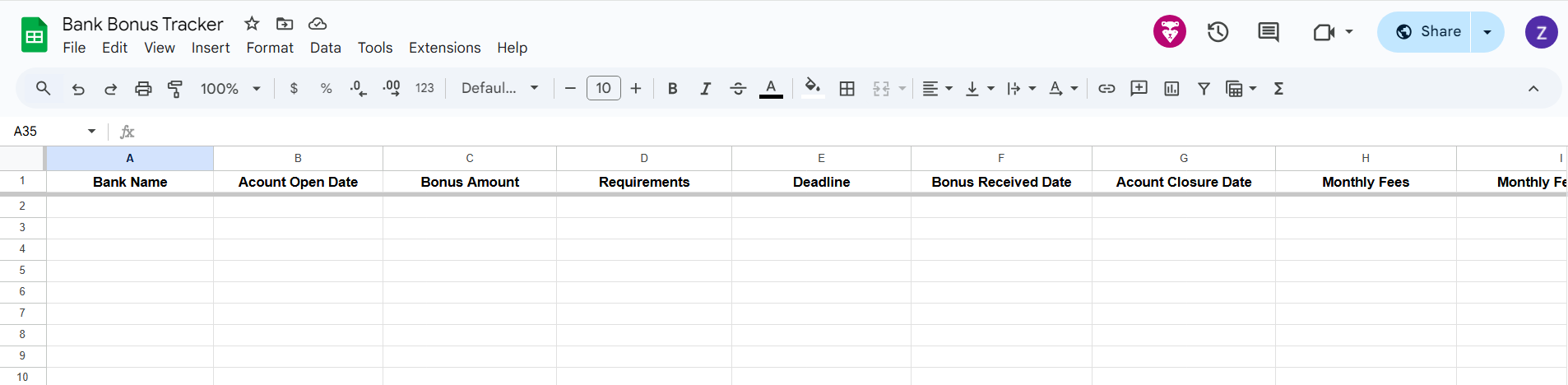

The most effective way to pursue bank bonuses and maximize your earnings is to stay organized by tracking all essential details in a note-taking app or spreadsheet.

Here’s a spreadsheet to help you keep track of your bank bonuses.

You might wonder how it’s possible to generate thousands of dollars year after year when there’s only a finite number of banks. It’s simple—you can repeatedly earn bonuses from the same banks.

Take Wells Fargo, for example. They allow you to earn another bank bonus 12 months after receiving your previous one. Here’s how it works: you open a checking account with Wells Fargo, complete the requirements, and receive your bonus roughly three months after account opening. Sometime after receiving the bonus, you close the account and wait 12 months from the date of your last bonus to open a new one. By utilizing this strategy, you can consistently earn a Wells Fargo bonus every 15 months.

You might also worry about managing multiple accounts simultaneously, but there’s no need to keep them all open after receiving your bonuses. You can simply close an account once the termination period, if any, has passed. A termination period is the timeframe during which closing your account may result in a termination fee or the forfeiture of your bonus. These periods typically last 3 to 6 months after account opening but can sometimes extend up to a year, depending on the bank's policy.

Another benefit of closing an account after the termination period is that it starts the clock for when you may become eligible for another bonus with that bank, as some banks determine eligibility based on how much time has passed since you last closed your account.

Risks

While chasing bank bonuses does come with risks, these can be effectively managed by staying organized and tracking all necessary details.

Monthly fees, for example, are something you’ll want to pay close attention to, ensuring you don’t lose money unnecessarily. Typically ranging from $12 to $15, these fees are charged by banks each month for maintaining your account. Fortunately, most banks provide ways to waive these fees by completing straightforward requirements, such as setting up a direct deposit or maintaining a minimum daily balance.

For instance, Chase charges a $12 monthly fee for its checking account, but this fee can be waived by receiving direct deposits totaling at least $500 or maintaining a minimum daily balance of $1,500.

Another potential risk is opening more accounts than you can effectively handle, which may make it difficult to complete the requirements for each bank bonus. To mitigate this, start slow, assess your ability to fulfill the requirements, and gradually take on more as you gain experience. Staying organized is crucial to avoid becoming overwhelmed as you manage a growing number of accounts.

Recommendations

With so many bank bonuses available, it can be overwhelming to figure out where to start. To make it easier, I’ve compiled a list of simple and lucrative bank bonuses to help you get your feet wet.

Recommended Bank Bonuses:

- Chase

- Bonus: $300

- Requirement: Receive direct deposits totaling $500 within 90 days

- Wells Fargo

- Bonus: $325

- Requirement: Receive direct deposits totaling $1,000 within 90 days

- Citi

- Bonus: $325

- Requirement: Complete at least two ACH transfers, Zelle transfers, or direct deposits totaling $3,000 within 90 days

- Bank of America

- Bonus: $300

- Requirement: Receive direct deposits totaling $2,000 within 90 days

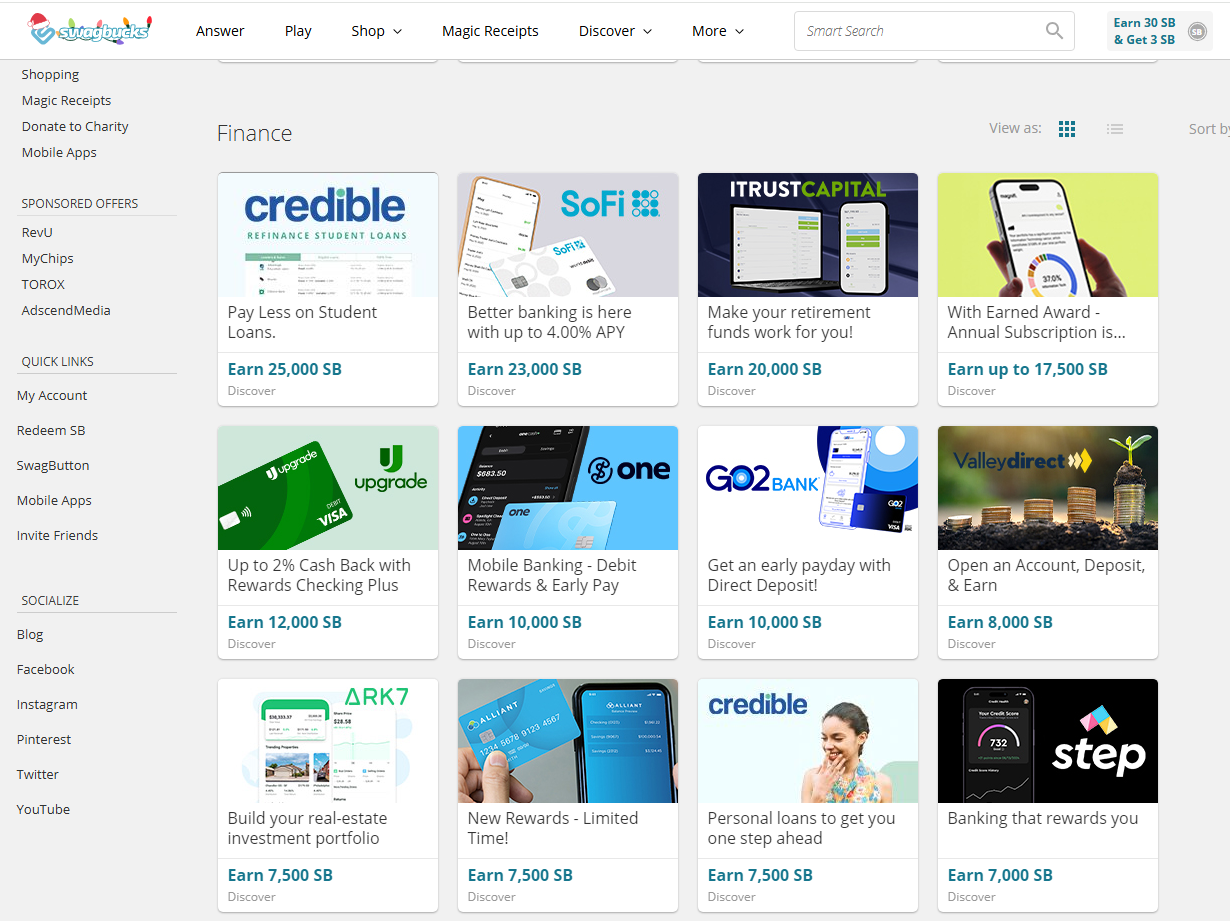

In addition to these bank bonuses, you can find a variety of offers on Swagbucks. Swagbucks is a trusted online rewards platform that partners with companies to promote their products and services. By signing up for offers and completing specific requirements, you earn points that can be redeemed for gift cards or cash. Essentially, Swagbucks acts as a broker, connecting you to valuable bank bonuses and other great deals across various industries.

Bottom Line

Bank bonuses offer an unconventional yet highly effective way to earn extra cash, often adding up to thousands of dollars annually. With your funds fully protected by FDIC insurance, the downside risk is minimal, making these bonuses a highly rewarding opportunity that’s hard to pass up.

To further boost your earning potential, you can also go after credit card bonuses. I'll soon be publishing a detailed post on how to combine these two strategies to maximize your gains. Be sure to subscribe to my newsletter so you don't miss out.

I hope you found this guide helpful! If you have any questions or thoughts, feel free to share them in the comments below—I’d be happy to help!

NewAgeFinance Newsletter

Join the newsletter to receive the latest updates in your inbox.